In the Work Programme for 2025 the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA) explains in paragraph 1.9 how the AMLA will create further regulations based on the AML Package:

To further pinpoint the relevant measures to be taken and the necessary alignment to be made specific questionnaires have been distributed to the relevant national supervisory authorities. The aim is to take stock of the specific regulations and guidance issued at the national level. A complete view of the content and the different approaches taken by Member States on the issues under discussion is key for AMLA. The aim is to ensure that pertinent proposals are put forward that seeks to align different practices and make sure that coherent and uniform interpretation is applied throughout the union.

Two WGs have been set up for the preparation of the three prioritized mandates. The WG on Risks work is focused on drafting RTS on lower thresholds and criteria to identify business relationships, and the Guidelines for business-wide risk assessment. The WG on Obligations will deal with the Guidelines on ongoing monitoring of business relationships.

These WG will be composed of representatives of NCAs and organized by AMLA staff. As the content of the L2/3 instruments should be consider the relevant features of different business beyond the financial sector, the Experts Network will help to ensure that specific knowledge from all the categories of OE is available. WGs can draw expertise from this network as needed, according to the type of topics included in the agenda of each meeting.

Page 23:

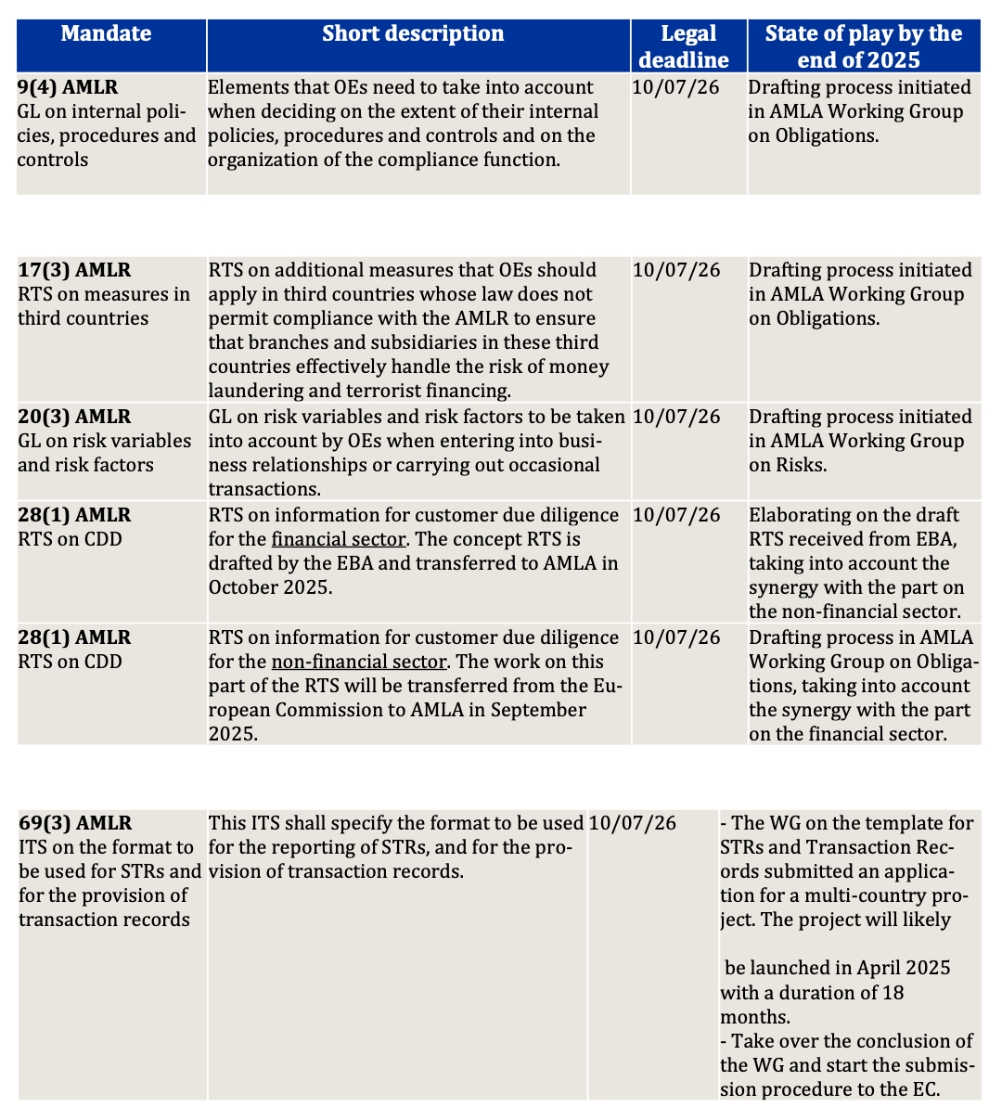

As AMLA is in the process of becoming operational, it is of important that the ‘Single Rule Book’ is progressively completed. To this end, AMLA is tasked with preparing 23 L2/3 measures before July 2026. The aim of these mandates is to bring about a maximum level of harmonization on three key areas: (i) the supervisory processes within the EU (10 mandates), (ii) the understanding and implementation of risks and mitigating measures by the OEs (8 mandates), and (iii) the Financial Intelligence Units (FIU) processes (5 mandates).

Page 35:

As for the Implementing Technical Standards (ITS) on templates and formats for STRs and transaction records as requested by article 69 AMLR, a multi-country project is set-up and supported by the European Commission’s Directorate-General for Structural Reform Support (DG REFORM)’s technical support instrument (TSI) and led by the Council of Europe.

Abbreviations

- GL = Guidelines (additional and more detailed rules)

- NCAs = National Competent Authorities

- OE = Obliged entitiy

- RTS = Regulatory technical standards (additional and more detailed rules, there is nothing ‘technical’ about them)

- STR = Suspicious Transaction Report

- WG = Working Group

Annex 1

In annex 1 the priorities of the AMLA are described. The additional rules are very relevant for obliged entities, especially these:

These additional rules (‘guidelines’, ‘regulatory technical standards’, etcetera) based on articles 20(3), 28(1) and other articles of the Anti-Money Laundering Regulation (AMLR) will become very relevant for every SME that is obliged entity in the EU, even though the rules may be incomprehensible.

Consultation

The only involvement of the customers of obliged entities and the obliged entities themselves, is foreseen by holding a public consultation on the rules drafted by the AMLA (‘draft RTS]). According to the working programma, the drafts are developed in 2025, followed by a three-month public consultation, concluding in the first half of 2026. After the consultation the AMLA expects to finalise the draft in the summer of 2026.

Final remarks

It will remain to be seen whether the EU will be able to make adequate rules for the large group of obliged entities that are SMEs, that are understandable and practicable to them.

The European AML/CFT-rules do not provide a low-threshold corrective mechanism that can be invoked by citizens (including obliged entities and their customers) if the detailed rules (RTS) are found to contain errors.

—

Read also: EU’s Iron Fist – Europe authoritarianly steamrolls over national supervisors and obliged entities | AML package, 10 mei 2022