In December 2023 the working paper The Reverse Revolving Door in the Supervision of European Banks was published [1].

The Halle Institute for Economic Research (IWH), where two of the authors of the paper work, in March published the press release Risk in the banking sector: four out of ten top supervisors come from the financial industry [2].

Though the scope of the paper is limited, it is interesting to read through.

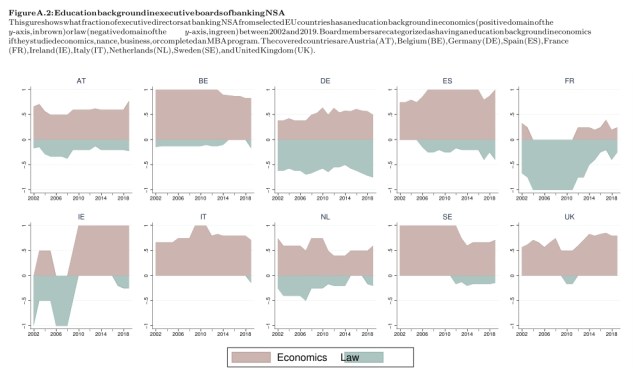

Amongst others the paper makes clear that in most EU-countries most supervisors have a economical background. Exceptions are Germany and France:

(click to enlarge)

While the impact of many ex-bankers at financial supervisors is interesting, I regret that no broader research has been done on the people active at the top of financial supervision in Europe. My impression is that it is a closed world that has little touch with ordinary citizens and small and medium-sized enterprises, who do get hit hard by the concepts devised by these top financial people, such as anti-money laundering and open finance.

Notes:

[1] Downlaod: ECONSTAR download page. The document is written by Stefano Colonnello, Michael Koetter (IWH), Alex Sclip and Konstantin Wagner (IWH).

[2] This is the machine translation of: Risiko im Bankensektor: Vier von zehn Top-Aufsehern stammen aus Finanzindustrie. The press release is here.