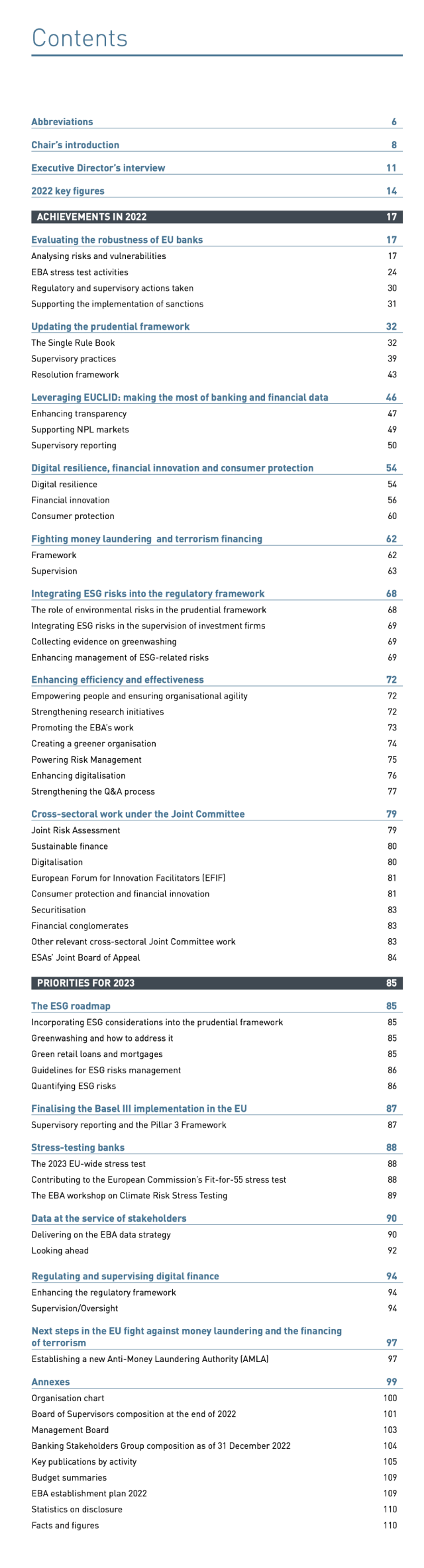

The European Banking Authority (EBA) published its annual report that sets out the activities in 2022 and provides an overview of the key priorities for 2023.

It is amusing to see EBA thinks it delivers ‘products‘ and that it can claim ‘achievements‘. It still is remarkable that public sector organisations find it necessary to use private sector terminology. EBA praises itself highly when they claim their rulebook is ‘evidence-based’. That fits well with the presumption that the world is controllable and humans adapt to theoretical concepts. Unfortunately, reality is different.

Nevertheless, it is to be hoped that EBA plays a useful role in supervision of financial institutions (FIs).

AML/CFT

EBA supervises FIs and national authorities in regard of anti-money laundering (AML) and countering financing of terrorism (CFT). On pages 62-67 of the report they write that they

implemented a holistic regulatory framework to ensure a consistent approach to identifying, assessing and managing ML/TF risk across all areas of supervision and across all stages of a financial institution’s life cycle

This is done through a lot of guidelines. The chapter describes organisational activities, like reviews of competent authorities’ approaches, implementation reviews and training.

EuReCa, the black sheep database of FI’s

EBA reports on the central AML/CFT database EuReCa, which brings together information on serious deficiencies in individual FIs’ systems and checks that expose these institutions to money laundering/ terrorist financing risk, and the measures national authorities took to correct those deficiencies. According to EBA EuReCa has become a key tool strengthening AML/CFT supervision and coordinating supervisory efforts across the EU.

Figures on EuReCa:

More information:

- Announcement by EBA, 12 June 2023.

- EBA’s 2022 Annual Report (pdf)